Cryptocurrencies have taken the financial world by storm, capturing the interest of investors and tech enthusiasts alike. As more people dive into this digital realm, understanding how to manage and withdraw crypto coins becomes essential. Whether you’re cashing out for a big purchase or simply reallocating your assets, knowing what to consider can make all the difference in your experience. From tax implications to security measures and various withdrawal methods, preparing yourself with the right information helps ensure a smooth transaction every time. Let’s explore these crucial factors together.

Understanding the Tax Implications

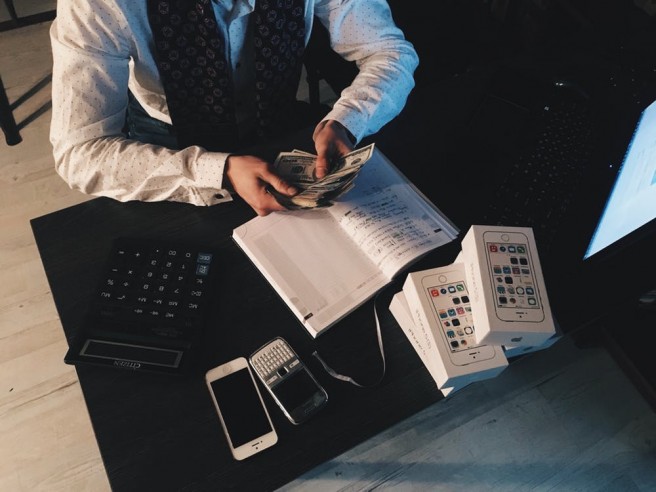

When it comes to withdrawing crypto coins, tax implications can be a complicated matter. Many countries treat cryptocurrencies as property rather than currency, which means that transactions may trigger capital gains taxes. If you sell or exchange your crypto for fiat money, the profits could be subject to taxation. It’s essential to track your cost basis—the original purchase price—so you know how much profit you’re realizing when you withdraw.

When it comes to withdrawing crypto coins, tax implications can be a complicated matter. Many countries treat cryptocurrencies as property rather than currency, which means that transactions may trigger capital gains taxes. If you sell or exchange your crypto for fiat money, the profits could be subject to taxation. It’s essential to track your cost basis—the original purchase price—so you know how much profit you’re realizing when you withdraw.

Also, consider holding periods. In some jurisdictions, assets held for more than a year might qualify for lower long-term capital gains rates. Understanding these distinctions can save you a significant amount on your tax bill. Always consult with a tax professional who is knowledgeable about cryptocurrency regulations in your area. They can help navigate the complexities and ensure compliance while maximizing potential benefits.

Security Measures for Withdrawing Crypto Coins

When it comes to withdrawing crypto coins, security should be your top priority. Start by enabling two-factor authentication (2FA) …

A high-yield savings account is a type of savings account that typically has a higher interest rate than a traditional savings account. This type of account can help you grow your money faster. If you’re looking for a safe place to park your cash, a high-yield savings account may be a good option for you. These accounts are FDIC-insured up to $250,000, so you can rest assured your money is safe. Additionally, high-yield savings accounts often have no monthly fees and offer easy access to your cash. This makes them a convenient option if you need to withdraw funds for an emergency expense.

A high-yield savings account is a type of savings account that typically has a higher interest rate than a traditional savings account. This type of account can help you grow your money faster. If you’re looking for a safe place to park your cash, a high-yield savings account may be a good option for you. These accounts are FDIC-insured up to $250,000, so you can rest assured your money is safe. Additionally, high-yield savings accounts often have no monthly fees and offer easy access to your cash. This makes them a convenient option if you need to withdraw funds for an emergency expense.

When you are applying for payday loans, it is important to gauge your financial position. By doing this, you will quickly know the exact amount of money you can render. Usually, payday loans are meant for borrowers whose incomes are lower. But most borrowers forget to consider their financial positions and they borrow a massive amount of money that they are unable to repay. This is one of the mistakes you are asked to avoid. Therefore, make sure that you consider your financial position …

When you are applying for payday loans, it is important to gauge your financial position. By doing this, you will quickly know the exact amount of money you can render. Usually, payday loans are meant for borrowers whose incomes are lower. But most borrowers forget to consider their financial positions and they borrow a massive amount of money that they are unable to repay. This is one of the mistakes you are asked to avoid. Therefore, make sure that you consider your financial position …

Most of the financial advice we get from friends and relatives are usually biased. For example, we make investment decisions based on our emotional affiliations to certain organizations or people, which is a grievous mistake in the financial world. On the other hand, an independent financial advisor offers financial advice from an objective viewpoint. All investment decisions are reviewed impartially to evaluate their economic feasibility and sustainability.

Most of the financial advice we get from friends and relatives are usually biased. For example, we make investment decisions based on our emotional affiliations to certain organizations or people, which is a grievous mistake in the financial world. On the other hand, an independent financial advisor offers financial advice from an objective viewpoint. All investment decisions are reviewed impartially to evaluate their economic feasibility and sustainability.